Emily is a calm, grounded, voice of reason when everything else might seem chaotic. She helped me to focus in on my priorities and gently pushed me to make commitments to both myself and my business. Her logical, strategic approach helped me to cut through the noise and break it down into tangible steps. A strategic wing-woman who any business owner would do well to have by their side.

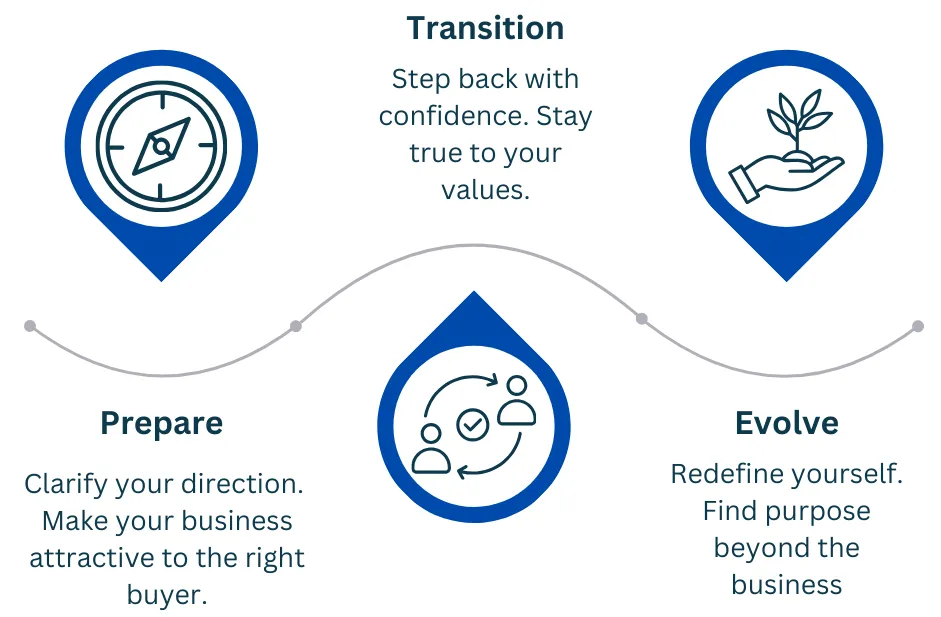

The Exit Compass Framework

Preparing for exit isn’t a single decision.

It’s a series of choices about you, your business and what comes next.

The Exit Compass Framework gives structure to those choices, so you’re not reacting under pressure, but preparing deliberately – maximising value while staying true to what matters to you.

I work with founders through the three connected stages of my Exit Compass Framework:

Who the framework is for

This is for founders and owner-managers of established SMEs who:

- Want to realise the financial value of what they’ve built

- Care what happens to their people, customers and reputation

- Know the business is still too dependent on them

- Are thinking 12–36 months ahead – or simply want to be ready to make the most of future opportunities

- Want an independent partner who isn’t selling them a financial product

You don’t have to know exactly when or how you’ll exit.

You just have to be ready to look at it seriously.

How we work together

I don’t offer a one-size-fits-all programme.

We work in phases, and at the end of each phase we review what we’ve learned and decide – together – what the next phase should look like.

Typically, our work might include:

- A focused strategy intensive to clarify goals, options and readiness

- Regular working sessions to shape the business and reduce dependency on you

- Touchpoints around key decisions, negotiations or transition moments

- Space to work through the personal and leadership shifts that exit brings

You stay in control of pace and scope. I bring challenge, structure and calm.

Phase 1 – Prepare

Exit readiness and direction

Before you talk to buyers, advisers or potential successors, you need clarity.

In the Prepare phase, we:

- Clarify what “a good exit” means for you – financially, practically and personally

- Map the realistic exit options for your business (trade sale, MBO, succession, partial exit and more)

- Take an honest look at where the business is today – including founder dependency, leadership depth, financial shape and key risks

- Identify what would need to change to create real choice and stronger value at exit

This phase is usually delivered through a strategy intensive (a half-day or full day), plus follow-up time to turn decisions into a working plan.

You’ll come out of Prepare with:

- A clear view of whether – and how – exit could work for you

- Your most credible exit routes, and what each would ask of you and the business

- A focused set of priorities for making the business more exit-ready

From there, we decide together whether to move into Transition, and in what shape.

Phase 2 – Transition

Shaping the business and reducing risk

Once you have direction, we turn to the practical work of getting the business – and you – ready.

In the Transition phase, we might work on:

- Reducing dependency on you – shifting decisions, relationships and knowledge into the wider team

- Strengthening leadership and structure – clarifying roles, responsibilities and how decisions get made

- Focusing on what drives value – so time and investment go where they matter most for your eventual exit

- Preparing for buyer or successor scrutiny – making it easier for others to see, understand and trust the business

- Navigating the realities of handover, earn-out or changing roles, if those are part of your chosen route

This is usually an ongoing partnership over a number of months. We agree the focus, cadence and format based on what will move the needle most in your specific context.

You’ll come out of Transition with:

- A business that is less reliant on you personally

- A stronger foundation for valuation, negotiation and handover

- Greater confidence in your leadership team and structure

- A clearer sense of when the business – and you – will be ready to move

Phase 3 – Evolve

Exit-ready leadership and what comes next

Exit isn’t just a business event. It’s a personal transition.

In the Evolve phase, we focus on:

- Your identity after exit – who you want to be when you’re no longer “the owner”

- How you want to use your time, skills and experience next

- What “enough” looks like – financially and in terms of commitments

- Maintaining important relationships – with the business, your team and your network – in a healthy way

- Closing this chapter well, so you can step into the next one with energy and intention

Some founders engage in Evolve alongside Transition; others prefer to focus on it as exit comes closer or shortly after completion. Either way, the goal is the same: you leave the business well, and move into what’s next with a clear head.

How this fits with your other advisers

The Exit Compass Framework sits alongside, not instead of:

- Corporate finance advisers / brokers

- Lawyers

- Accountants and tax specialists

- Financial planners / IFAs

They handle the deal, the legal detail, the tax and the investment planning.

I focus on you and the business:

- making sure you’re pursuing the right kind of exit

- strengthening the business so it can support that exit

- and helping you lead – and leave – in a way you’re proud of.

This means you show up to those conversations clearer, better prepared and in a stronger negotiating position.

Next step – have a conversation

If you’re starting to think seriously about exit – or want to be ready when the time comes – the easiest next step is a conversation.

Exit Readiness Conversation - A focused, no-pressure call where we:

- Explore what a good exit could look like for you

- Take a high-level look at where your business is today

- Discuss which parts of the Exit Compass Framework might be most useful now

- Decide whether working together would be a good fit

👉 Book an Exit Readiness Conversation.